Free income tax services are available for Central Piedmont students, faculty, and staff until April 15 through the Volunteer Income Tax Assistance (VITA). Qualified participants earn $64,000 per year or less.

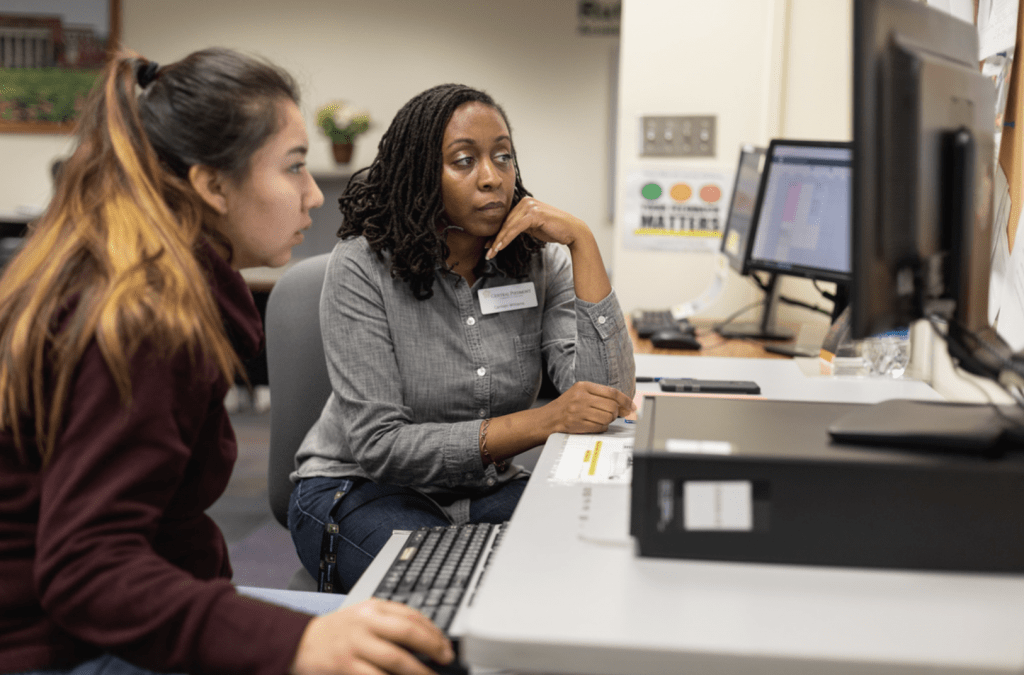

Eligible individuals are able to participate in two ways, through a Virtual Intake Center or by sitting down in person with a VITA trained tax preparer.

Virtual Intake Sites allow participants to bring the tax documents to a designated location where the tax documents will be uploaded through a secure server, and prepared by a trained VITA tax preparer.

Virtual Intake Sites are available at Cato Campus, Building III, and Room 118 and at Harper Campus, Harper 4, Room 218. Learn more here.

In-person sit-down appointments will be available in the Overcash Building on the Central Campus, in Room 232 (next to Tate Hall). Operating hours for the in-person site are:

- Monday: 10 a.m. – noon and 1 – 7 p.m.

- Tuesday: 8 a.m. – noon and 1 – 5 p.m.

- Wednesday: 8 a.m. – noon and 1 – 5 p.m.

- Thursday: 10 a.m. – noon and 1 – 5 p.m.

- Friday: 9 a.m. – noon

- Saturday: 9 a.m. – noon (Walk-Ins Only)

Click here to make an appointment.

Please make sure to bring all necessary paperwork with you to your appointment:

- Proof of identification (photo ID). If filing a joint return, both spouses must be present to sign required authorization forms

- Social Security Cards or an ITIN letter for you, your spouse, and dependents

- Wages and earning statements (W2, W2-G, 1009-R,1099 Misc., etc.) from all employers

- Interest and dividend statements from banks (Form 1099)

- A copy of last year’s federal & state tax returns, if available

- Proof of bank account with routing and account numbers for direct deposit

- Total paid to a daycare provider, including the daycare provider’s name, address and tax identification information, such as a social security number or Employer Identification Number (EIN)

For the 2022 tax season, Single Stop has partnered with the Central Piedmont accounting and finance program to offer free Volunteer Income Tax Assistance (VITA) on Central Campus. If your household income in 2021 was $72,000 or less, you could qualify to take advantage of this free tax preparation resource. Students, staff, and faculty (including immediate family members) are eligible to receive free tax preparation.

For the 2022 tax season, Single Stop has partnered with the Central Piedmont accounting and finance program to offer free Volunteer Income Tax Assistance (VITA) on Central Campus. If your household income in 2021 was $72,000 or less, you could qualify to take advantage of this free tax preparation resource. Students, staff, and faculty (including immediate family members) are eligible to receive free tax preparation.